The way people find products and services online is evolving and it’s important for marketers to keep track of these changes, especially if their business is focused on selling online.

For many people, the online purchase journey begins with search engines, usually Google. So it’s not surprising that paid search advertising and search engine optimisation (SEO) take a significant slice of the marketing budget. Research indicates that paid search accounts for almost a quarter of the average total marketing budget (24%), with SEO not far behind on 18%, representing the two largest sources of investment for the average marketing department.

This makes perfect sense – it’s essential for marketers to monitor and seek to improve the visibility of their company and its products in Google and other search engines.

In recent years, however, some online shoppers have started going directly to retail marketplaces such as Amazon and eBay when they want to find products- cutting search engines out of the process altogether. After all, if you go to Amazon it can take less time and fewer clicks to move from searching for a product and clicking to purchase (especially if you already have an Amazon account). And as more people move to mobile devices, it is much easier to stay on one site to search and make purchases, rather than having to continually switch back to Google as you search.

With figures indicating that Amazon now has around 270 million user accounts, Google is well aware of the threat from the online retail site: “People don’t think of Amazon as search, but if you are looking for something to buy, you are more often than not looking for it on Amazon”, Eric Schmidt, Google’s Executive Chairman has been quoted as saying.

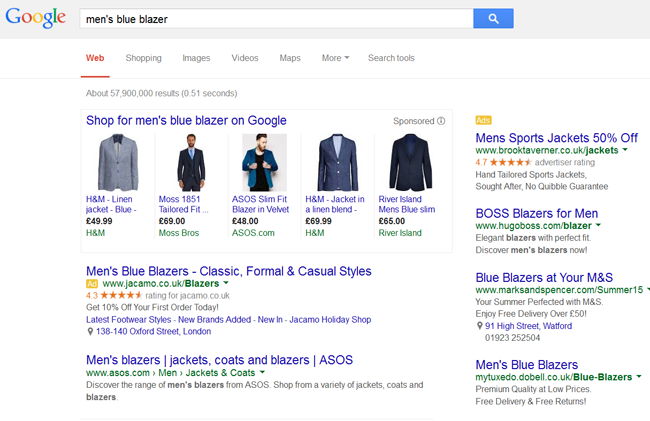

In response to the threat, Google transformed its Google Shopping service by making it a paid for service requiring retailers to buy Product Listing Ads (PLAs), which include product images, prices and descriptions. Google displays retailers’ PLAs in its search results for appropriate keyword searches – for example a search for ‘men’s blue blazer’ will throw up a number of PLAs showing blazers from a selection of retailers. So shoppers receive instant, comparative product information from a variety of retailers on Google‒ which competes directly with the information available from sellers on Amazon.

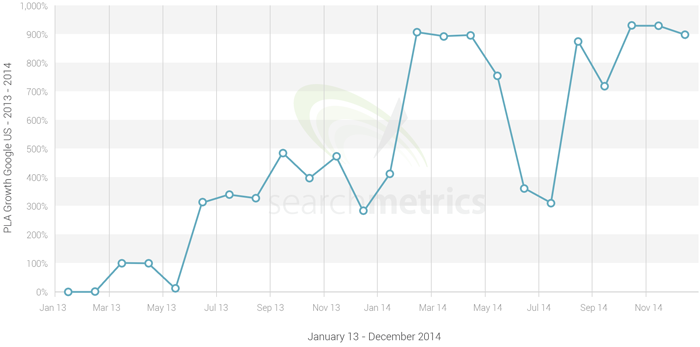

Retail marketers have recognised that value of the Google Shopping service and are increasingly using PLAs to help drive product search. In fact Searchmetrics’ US data shows that for the number of PLAs grew by 900% over the course of 2013 to 2014 (see chart).

But Amazon and eBay are not the only threat to Google in the area of product search. More recently, people are also starting to use social media to discover information on products/services. According to research by Forrester, Facebook is the second most popular product search service after Google – and other platforms such as Twitter and Pinterest were also found to be used.

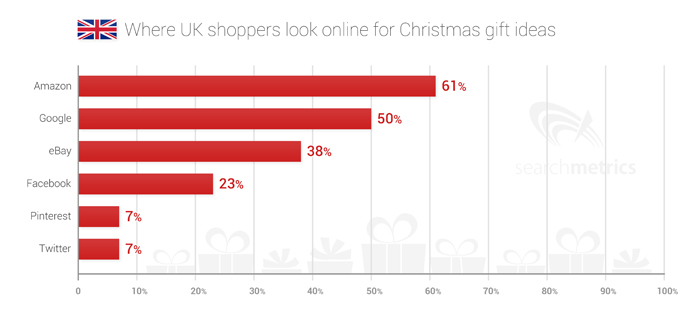

At Searchmetrics, we conducted a survey during the 2014 holiday shopping season which picked up on similar patterns of buyer behaviour. The survey suggested that Facebook is fast catching up with big players, such as Amazon and Google. And, more than one in five UK consumers turned to Facebook friends, company pages, ads and promotions for Christmas gift ideas. If people are turning to social media sites such as Facebook to help them find products during the busiest part of the retail year, then it’s likely that this behaviour also occurs to some extent throughout the rest of the year.

The major benefit of searching for products and services on social media, including Facebook is that you get to see feedback and preferences from other consumers, including your own friends and followers. This credible third party feedback from people that shoppers know can be very powerful.

To boost Facebook’s search capabilities, in early 2015 Mark Zuckerberg announced plans to build out search tools to analyse the trillions of posts of indexed content in a bid to provide more sophisticated search facilities for users. This indicates that Facebook is planning to increase its profile as a tool for online product search and intensify the competition.

One further area of evolution in product search is the rise of mobile search. In fact, evidence suggests many consumers use their mobile devices while actually in stores in order to compare the features and prices of products they are seeing on the shelves with those they can find through online searches. The importance of mobile is underlined by Google’s recent mobile-friendly algorithm update – which rewards web pages that are easier to view and navigate via a mobile phone, with higher search rankings.

The key takeaway here for marketers – especially retail marketers – is to embrace a multi-‘channel’ approach when it comes to helping people search for or discover their products and services online; they need to be monitoring and trying to boost their visibility across multiple search engines, networks and devices. It continues to be essential to track and maintain visibility in both organic and paid Google searches as well as searches on other important search engines. It’s also now becoming increasingly important to monitor and build a strong presence across social networks such as Facebook, Pinterest and Twitter and to ensure links to your web content and product information are regularly shared on these sites. Lastly, even if your business is not present on marketplaces such as Amazon and eBay, it may be worthwhile monitoring these sites to keep abreast of competitor’s activities.

*Searchmetrics conducted a survey of 1000 UK adults via online survey company, Usurv in w/e 5 December, 2014.