Black Friday together with Cyber Monday make up one of the busiest shopping weekends on the calendar: last year alone UK shoppers spent £3.3bn over the four day period, and this holiday season we’re likely to see even greater demand for products and higher sales. However, this huge influx of sales will invariably lead to a spike in customer returns. Buyer’s remorse and poor gift choices, coupled with relaxed return policies and the increase in online sales (which bring a much higher return rate), all contribute to the reason-for-return. No matter the motive, millions of pounds worth of merchandise – once gifted and unwrapped – will be heading back to retailers post holiday. Having a plan in place for those returns that can’t be put back on virtual shelves is crucial and can mean the difference between winning and losing this holiday season.

The true cost of customer returns

For e-Commerce retailers the problem of managing customer returns is intensified as the logistics of trading in an increasingly global marketplace become ever more complex. The true cost of returns can vary greatly depending on the location of the customer – for example, Germany has the highest return rates in the EU, at around 50%; this is due mostly to a buyer culture that tends to order multiple sizes and colours to try on with the intention to return those that don’t work or fit. In every country customers can return items right up until the local statutory law dictates. The length of time it can take to get the item back and re-processed, the refund given and the product marketed for re-sale can be significant. Retailers must account for this in their cash flow.

Getting the best price for returned stock

Most e-Commerce retailers have a process in place for returned stock that has been slated for the secondary market. If this plan includes selling to a couple of liquidators or middlemen, it may be worth reassessing. The problem with this approach is that liquidators are master negotiators and so they’re likely to barter you down on price, meaning that you aren’t getting the best price for your stock. In addition, you’ll have to spend a significant amount of time discussing prices and terms with them, which distracts you from your core business activities.

Retaining control over how your brand and products enter the secondary market is another important factor. When selling to a liquidator, you are handing the responsibility for downstream sales to them and have little control over who is eventually buying your inventory!

A far better approach would be to remove this reliance on a few buyers and instead open up the market to literally thousands of buyers, not only in your local domestic market but globally. Utilising a technology-driven solution to reach a much wider audience means that instead of being forced to negotiate your prices down, you can actually push them up. More buyers means more competition and a better return on your unwanted and returned stock.

Buyers for your Black Friday returns

Setting up a customized B2B online auction marketplace for liquidated stock is one way to make this happen. Retailers can also leverage an established B2B liquidation marketplace. Either way, they’ll be making their merchandise available to thousands of business buyers, ensuring that they can reclaim the highest returns on unwanted stock (not only from Black Friday/Cyber Monday, but all year long). This type of solution is also promotes a quick sales cycle: by having an online auction solution in place, retailers can quickly and effectively list products slated for liquidation to thousands of interested and eager buyers. This process not only makes sense from a logistical perspective, but has a number of strategic benefits too, including proprietary market intelligence in the form of real data on market prices.

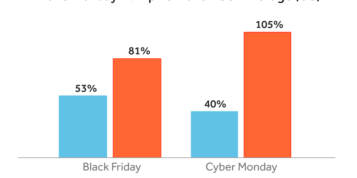

A number of leading retailers across the world are using web-based, technology-driven approaches to manage their unwanted and excess stock and have been increasing recovery rates by 30-80% and sometimes much more.

In-house or outsource?

It is worth noting that it can usually take specialist skill, insight and understanding to deliver optimal results from a technology-based auction solution. From understanding how best to assemble inventory and ‘lots’ to how to target, drive and sustain the right buyers is critical to getting the best returns and recovery. If you are concerned that an in-house team may not have the bandwidth or capability to take on a large-scale project like this, it could be worth seeking out help from a third-party team that has the experience and understanding to help make your online marketplace a success. When choosing a third-party provider be sure to look for:

Online marketplace expertise: The sales platform offered must be well designed, flexible and scalable. Make sure your partner has extensive experience in managing marketplaces and developing auction strategies to maximize your results.

Targeted demand generation: A good partner will have a proven track record of growing custom buyer bases across all categories and conditions. This is not only about quantity as buyer quality matters too!

Logistics services and support: Make sure the partner has experience working with a variety of third party service providers to ensure seamless integration. This should include hands on client support, logistics, inventory handling and warehousing.

In summary, unless you have a zero-returns policy in place, which in today’s competitive marketplace simply isn’t possible, there’s no way you can escape the surge in Black Friday and Cyber Monday returns which will be heading your way over the coming weeks. By thinking ahead and putting smart, strategic technology-based solutions in place that are not only measurable but highly effective, you can ensure that you remain firmly in the driving seat when the post-promotion blues kick in.