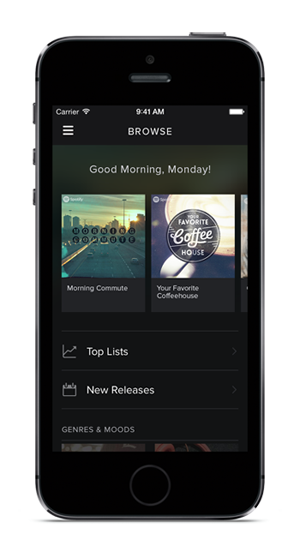

Spotify faces a number of challenges as it expands into the world of video. One is the user experience. It has proven that it can excel at the audio user experience with features such as social discovery and playlists. But video is a different kettle of fish.

Speculation was rife ahead of the launch that video would be positioned as the centerpiece of the application design to gain eyeballs, clicks and shares. In fact it is not. Perhaps there was concern about alienating current users in the short term and video will evolve to become more prominent.

Like Netflix, some of Spotify’s success can be attributed to its great user experience, regardless of the device used. The challenge for Spotify is delivering that same support with video. This is a far more complex proposition – especially across the Android ecosystem – and requires substantial investment.

But perhaps the fiercest battleground is in monetising video content.

While mobile advertising has been a hot topic for many years we have now reached a tipping point. It has the momentum of a runaway train with all the social media and consumer application players clamouring to jump on board and drive the engine.

Spotify’s move into video follows a similar pattern to developments at Snapchat. Key to broadening both portfolios and increasing the value of the organisation requires monetising services with mobile advertising.

Although some 48 million consumers use the free Spotify services, the company derives little value from this enormous audience. Meanwhile the competition is heating up with Apple Music poised to skew this market, piling on the pressure.

But have no doubt the opportunity for mobile advertising is huge. Search ad spending might have dropped in 2014 but mobile video ad spending grew a whopping 50 per cent.

Like Snapchat, Spotify recognizes there is an increasing demand for mobile video ads because of the higher CPMs, compared to display ads. The roadblock is actually the relative scarcity of premium video.

By getting users to hold their finger on the screen to see the ad, Snapchat has done a great job in this area and found the ideal way to measure user engagement. Spotify will need to come up with something as creative as this because unlike its traditional music service, which usually plays in the background, video requires the user’s full attention.

It will also have to use sophisticated analytics to prove to advertisers that ads were clicked and watched through, not skipped.

Unlike Spotify, whose approach involves in-house development, other large companies such as Facebook, AOL and Yahoo! have bought advertising technology specialists to get into video advertising. Their strategy has been based on the fact that video monetisation technology is constantly changing and getting it right is a black art that requires substantial resources.

Only time will tell whether an in-house approach will enable Spotify to scale up fast enough and win out in the long run.

We will stay tuned to see how this exciting marketplace pans out.