Paid search is one of the biggest single budget items on the digital marketing media plan and even small lifts in performance can equate to tremendous gains for enterprise-level advertisers in terms of increased ROI and reduced CPA.

Social advertising represents a smaller but growing area of spend, but what if Search and Social actually worked together, with exposure on one platform having a beneficial effect on the other? And if this is the case, what level of social spend is required before you can begin to see positive effects on search?

This is what Kenshoo set out to test in our recent study, The Facebook Added Value Series: Volume 2: Finding the Sweet Spot for Search and Social Investment.

The purpose of the research was to analyse the relationship between Facebook advertising and paid search performance using live campaign data from the leading global information services company, Experian. Commissioned by Facebook, Kenshoo gathered the data, undertook the analysis, and documented the findings in the white paper in collaboration with the Facebook Marketing Science, Advertising Research group.

The campaign targeted both branded and non-branded keywords, with the goal of driving online conversions (in this case the conversions we tracked were credit report applications from Experian’s website). We ran four test groups; with three groups subject to Facebook advertising divided into low, mid and high categories and a control group that did not benefit from Facebook advertising.

Paid search conversion activity increases as advertisers spend more on Facebook

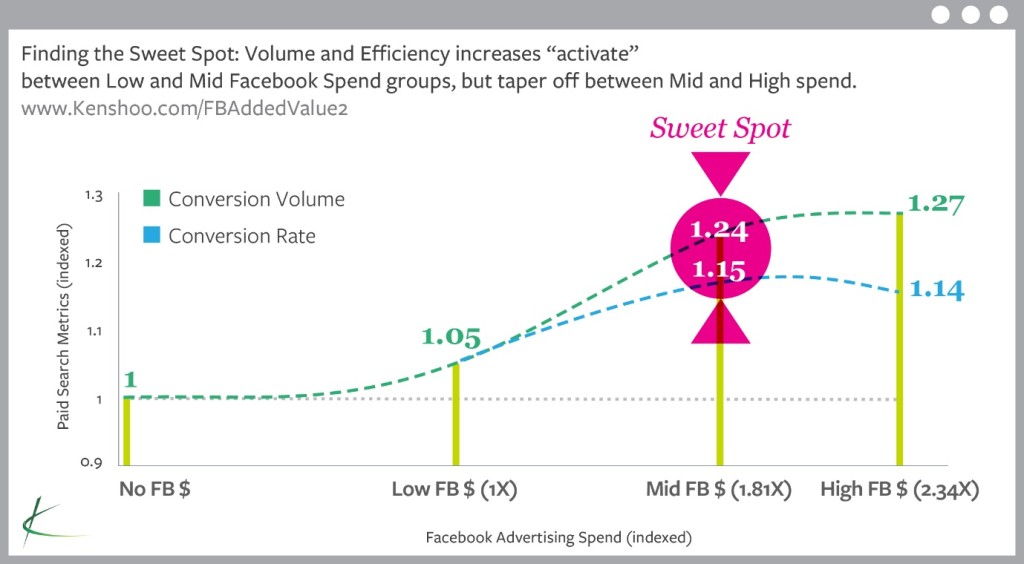

The top takeaway from the study was that paid search conversions increased as Facebook spending increased, with evidence of a minimum spend required to activate the cross-channel benefits – and also a point after which returns from further social advertising produce diminishing returns.

When we compared the three groups that benefited from Facebook advertising with the control group (which received no Facebook advertising), we found that on average total conversions increased 19% and the conversion rate increased 11%. The study also revealed that cost per acquisition (CPA) decreased 10% (with the increase in conversion rate fuelling this average drop across the three groups benefiting from Facebook ads).

The results support the view that adopting a multi-channel approach, combining search and social advertising, helps build momentum, reinforcing key messages and communicating calls to action across channels. Ultimately, in this example, we have strong evidence that being exposed to social advertising from a brand makes people more receptive to paid search ads from the same brand.

Getting to the ‘sweet spot’

As discussed earlier, the research points very strongly to a minimum spend required before the cross-channel benefits are activated and also a point of diminishing returns. This convergence of the minimum and maximum spend ratio, highlights a “sweet spot” for achieving the most effective cross-channel impact – indicating that advertisers can work out how to spend the least to get the maximum combined benefits.

The graph below helps to illustrate this point more clearly.

There is a clear “activation effect” in this test between the Low and Mid FB $ (spend) groups, but the smaller gains between Mid and High indicate additional spending may not yield proportionate levels of improvement (or may require spending levels beyond the scope of this test).

So what does this mean for Facebook advertisers? Here are 3 recommendations included in the report:

1. Find your Facebook advertising to paid search “sweet spot” spend ratio: Facebook advertising can positively affect your paid search performance., It may not yield major gains every time with every campaign, but the data is clear that this synergy does exist and it’s up to you to figure out how this cross-channel force can be harnessed in your marketing environment. It may be worth performing similar experiments to identify how various levels of Facebook spend boosts paid search performance versus an unexposed control group.

Compare those results to your acquisition costs. Find your sweet spot spend ratio and then do more testing to refine your insights.

2. Go granular – find the elements that seem to work best together: The next level of research after finding your sweet spot spend ratio is to start testing which Facebook advertising elements work best to drive specific paid search lifts. For example, you may find that the greatest impact comes from targeting a certain type of Facebook audience demographic or likes and interests. You should also test different bids, ad formats and messaging. Use this granular testing to achieve small lifts in performance.

In the long run, these tiny improvements have the potential to turn into big gains, as well as provide deep insights to help drive more cross-channel synergy among the rest of your digital marketing channels.

3. Implement cross-channel measurement and attribution models: Cross-channel marketing requires cross-channel measurement. In order to better understand the relationship between Facebook advertising and paid search – or any combination of your marketing channels – you will need to have cross-channel measurement to provide an accurate picture of which media mixes drive the highest performance.

More than ever, digital marketing should be viewed as an eco-system, not merely tactical campaigns integrated across individual channels. Brands who harness the power of using search intent to drive social campaigns and who optimise social campaigns to boost paid search performance will see substantial ROI and maximise the effectiveness of their digital budgets.