As most digital marketers will know by now, Google made major changes to its desktop search engine results pages (SERPs) at the end of February. Essentially, it has removed the right hand side ads that used to appear on desktop searches, meaning the layout of desktop search results now closely resembles those on mobile, which already have no right hand side ads.

Google is now showing a maximum of seven paid search ads on the desktop – three at the bottom and up to four above the organic results, with the fourth ad only appearing on search queries that Google deems “highly commercial.” However, Product Listing Ads are still shown on the top and right hand side of the page, meaning that many users may not see an immediate difference in terms of their view.

So what does this change mean for paid search advertisers? Given the short time between announcing the change and rolling it out (around a week), many marketers were worried about the impact on their campaigns. With less ad slots available, competition (and hence CPC rates) could increase dramatically, particularly on competitive keywords, while impression levels were expected to decline.

What has changed?

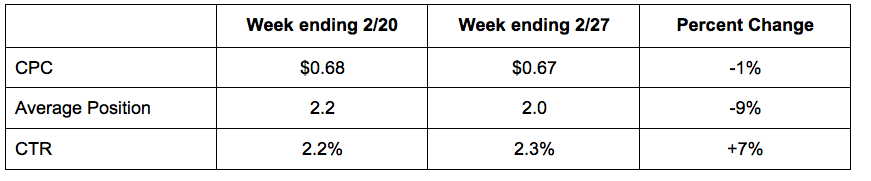

After a week of the new results page, we measured the impact, comparing key metrics with the last week of the old format. Some of the results were actually surprising, at least in the context of the predictions.

Impressions did decline, leading to a rise in click-through rate (CTR) of one tenth of a percent, which represents a 7% increase over the previous week. However, rather than a huge increase in CPC as advertisers scrambled to compete for fewer slots, CPC actually declined by 1 cent (roughly 1%). Average position of search ads improved by 0.2, essentially moving them closer to the top of the page on average.

There were no major variances in click or spend volume as compared to the weeks preceding the change, with a small increase in clicks and a smaller increase in spending due to the drop in average CPC that were mostly proportional to what we would expect from normal fluctuations.

Having seen the results, we can now provide explanations of the data:

1. On why click-through rates (CTR) have risen

When you think about it logically, it makes sense that CTR has increased. The majority of clicks are for ads in top positions, so the “lost” impressions from the ad positions that were removed did not have many accompanying clicks. So the numerator in the CTR calculation (clicks) is largerly unchanged, while the denominator (impressions) got smaller. After all, people still have the same intent when they search – they are just presented with fewer ads to choose from in the results. We saw something similar when Facebook changed its focus from its right rail ads to the News Feed.

2. On why CPC stayed flat while average position improved

The expectation was that CPC would rise as competition increased for fewer available slots, and that any rises in average ad position would be offset by CPC increases due to changed bidding strategies.

This clearly wasn’t the case, for two key reasons:

- Most of the worries were about the impact on individual keywords. However most advertisers have very large sets of keywords, all of which can behave differently. Some keywords are fighting harder for their position, but these are counterbalanced by keywords that may be losing that fight, and a bidding algorithm that works across groups of keywords will take all of these different contributions into account.

- For average position, the smaller number of ads per page can have a material effect on how this metric works in aggregate, as many of the impressions from lower positions simply do not exist to pull the average away from the top. This may simply be a by-product of how the maths works on the new layout.

Therefore, we are seeing that the winners are driving the overall performance of the portfolio, delivering better engagement at the same price.

3. On why click and spending volume stayed steady

As stated when we looked at CTR, the amount of intent on any given search engine results page hasn’t changed. The number of searches themselves hasn’t changed. So it stands to reason, at least in hindsight, that the number of searchers who intend to click on a results link hasn’t changed, either. Subsequently, the valuation of those clicks isn’t all that different now that there are slightly fewer options to click on.

The good news for advertisers is that Google’s change hasn’t had the catastrophic impact on prices, position, or budget that many expected. In fact it has been quite a positive result – with overall improvements to CTR, ad positions and CPC, which benefits advertisers and users at the same time.