In today’s highly competitive retail market, the benefits of attracting and retaining loyal customers don’t need too much explaining. Industry analysts agree that acquiring a customer costs 5-10 times more than retaining a customer.

There are a couple of key reasons for this:

Lower cost of converting an existing customer to a sale versus a new customer – not only are marketing costs much lower, but existing customers are much more likely to make a purchase than new prospects are. They are familiar with the brand, they know the service and quality and ultimately know what to expect from the experience.

Spend typically increases over the course of a customer’s lifecycle – There are reams and reams of research studies that have showed a strong, positive correlation between the number of purchases and AOV in recent years. And it makes sense – as a consumer’s confidence in the retailer or brand grows, so too does their inclination to spend more and channel more of their purchases toward that one favoured name. Not only to they spend more, but retained customers also spend more frequently.

The lesson is simple – retailers must retain customers. But in a highly competitive market, this is easier said than done. There are hundreds of reasons why a customer might not return to make that second purchase.

The good news is that there is a science to customer acquisition and retention – one that allows you to understand both your current dynamics and where you need to focus to boost growth.

The science

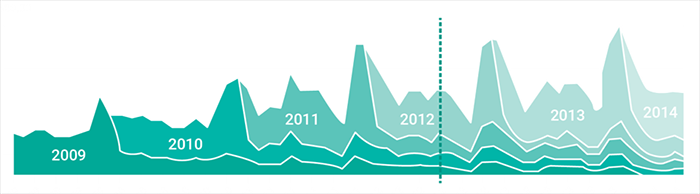

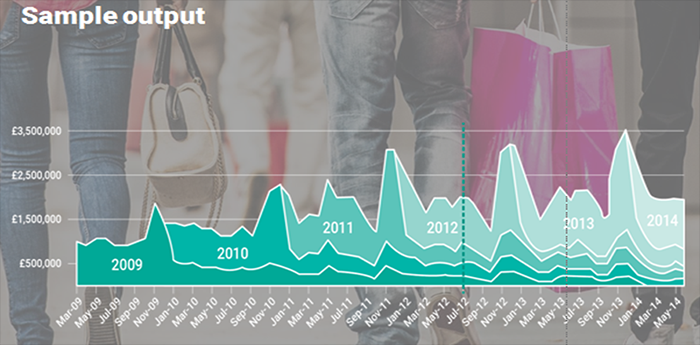

A cohort analysis, leveraging historic data, as well as market data and industry benchmarks, enables you to see your historic patterns of acquisition and retention. It looks something like this:

Sample output:

At a high level, the cohort analysis shows you the extent to which your business is reliant on newly acquired customer spend. This may provide the first indication of a limit to growth, especially if your market is relatively finite.

At a high level, the cohort analysis shows you the extent to which your business is reliant on newly acquired customer spend. This may provide the first indication of a limit to growth, especially if your market is relatively finite.

It’s then useful to drill down further into the drivers of historic acquisition and retention performance, to help you answer questions such as:

- How many loyal customers do you have?

- How many new customers come back and purchase a second, third, fourth time, and so on?

- What is the average time between first and second purchase, and so on?

- What are the retention metrics that need to be reached in order to reach future revenue targets?

What counts as a “loyal” customer?

All of this begs the question – what does loyalty mean? Most businesses talk of the need to recruit “loyal” customers, but often they do not have a clear, shared understanding of what loyalty really means.

Loyalty is ultimately about customers being highly likely to shop with a particular retailer again. At eCommera, we define this as a customer having a 90% likelihood of returning to purchase again. The next question is ‘how many purchases does a customer need to make before they can be considered “loyal”, how long does this process take, and what is the associated average order value.

These metrics will have implications for various business decisions – such as your retargeting campaign, the personalisation of your CRM messaging, and the investment you make in recruitment and retention against the anticipated value of the lifetime spend. Of course, this will vary greatly by category – a sofa retailer will have a much longer time to loyalty than a fast fashion retailer.

Nevertheless, the same questions apply regardless of retailer category:

- How long does it take to transition to “loyal”?

- How many new customers do you need to acquire to achieve revenue aspirations?

- How many newly acquired customers do you need to convert to loyal (against time)?

Using our proven model, we recently supported a leading premium UK retailer to set realistic growth targets and identify levers to achieve them. The original aspiration was to grow omni-channel revenue three-fold in the next three years. However, modelling the scenario using insight gathered on historic performance, it became apparent that the objective was unrealistic, as it would have meant the business needed to:

- Increase the number of new customers acquired each year by 20% – when it had already recruited almost half a million customers in the UK in the previous year

- At the same time increase retention rates

Therefore, we modelled a more achievable scenario and made specific recommendations to achieve that growth. Our recommendations included launching an eCRM programme, reviewing the loyalty programme, and improving the customer’s online experience.

How can you get more loyal customers?

Once your cohort analysis is complete, there are several areas you can look at to help increase your number of loyal customers, as well as reducing the time to loyalty:

- Customer experience: Do you survey customers regularly to get first-hand feedback on the customer experience? Do you monitor delivery against customer promise?

- Email: What is your current method of email collection? Do customers have to opt-in or opt-out? Do you have a calendar of email activity set up – such as welcome emails, timely emails to re-engage customers to drive second purchase?

- Retargeting: Do you have a lifecycle campaign in place? Do you target customer groups?

- Stock availability: What is your views availability? Do you have in stock what your customers are looking to buy?

- Competition: Are customers buying from your competitors? Do you face competition from discounters?

- Pricing and promotion: Is your pricing more expensive than your competition? Do you offer market competitive promotions?

Replacing a once loyal or established customer with a new recruit can be very costly, so it’s worth investing time and effort in conducting a thorough cohort analysis to discover how you can boost customer retention rates and reduce time to loyalty.