Our high streets and town centres are facing a number of challenges to survive one of them is technology, a new report by Experian outlines how retailers might embrace technology to survive and thrive beyond 2020.

Mary Portas’s report, The Portas Review has firmly put the spotlight on the high streets of Britain. Less than half of our retail spending is on the high street and this figure is expected to decline even further over the coming years.

Experian have recently released findings into its own retail and economics data to understand how UK consumers are changing and what impact this will have on the 1,200 town centres across the country between now and the end of the decade.

Amongst other areas, the Experian report entitled Town Centre Futures 2020, looks at the impact technology will have on our town centres and high streets by 2020 and beyond.

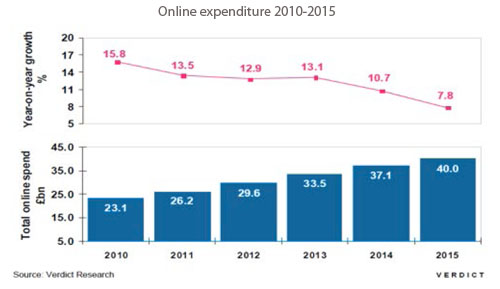

According to the Experian report, between 2011 and 2015 the proportion of all retail spending accounted for by the Internet is expected to increase from 8.9% to 12.1%, albeit at a slower rate of growth than has been experienced in the past.

The growth driven by the increasingly take up of new technology but will eventually begin to reach a mature phase.

Challenging times have made the consumer more price conscious and savvy, we are now prepared to spend more time looking for value, turning to online sources such as price comparison and voucher websites to find the best deal.

This has led to the rise of daily deal sites such as Groupon, allowing high street businesses to bring customers into their venue, but for a lower margin. It is too early to say whether these customers are then converted into long term customers, or do they simply move onto the next ‘deal offering business’.

Smartphone and mobile devices has also played a role in influencing retail sales, recent research by Deloitte Digital revealed smartphones are driving £15bn worth of sales for retailers.

There is also the rise of what is known as ROBO (Research Offline Buy Online) shoppers, consumers are going into retail stores to research their product but then buying online after looking around for the best deals.

Some of the ways the Experian report suggests town centres could react to these changing consumer habits include:

- Greater numbers of businesses adopting the ‘click and collect’ model.

- Town centres marketing themselves as convenient ‘hubs’ for picking up products ordered online, through the use of high street lockers or other dedicated spaces.

- Pop up store windows enabling people to interact with products via mobile devices.

- Virtual stores in offline places: stores offering QR codes to see their wider range.

- Restaurants making dining experiences interactive.

- Mobile apps to enhance in-store experience.

Ultimately retailers and town centres will need to embrace technology to enrich the customer shopping experience, as James Miller, lead consultant, Retail & Property at Experian, said:

“The Portas Review put the spotlight on the historical reasons for the decline of town centres, but there’s been little or no attention paid to potential drivers of future change. The trends we’ve highlighted will change the complexion of the high street forever. By 2020, the UK will be a very different place with a shift in shopper make up and a far greater role for technology.”

“The UK’s high streets and town centres have a careful balancing act to play. How they tackle these major drivers of change will be crucial. They must fulfil the modern need for convenience and value of those with increasingly limited resources and incomes, but not to the detriment of quality and service, sought by older and more affluent consumers. At the same time they need to embrace technology to enrich the shopping experience by combining online shopping with the often more convenient option of collecting goods in the town centre.”